Regulatory Challenges and Risks for Small Banks

Small financial institutions, including community banks and credit unions, face unique challenges in adhering to Anti-Money Laundering (AML) regulations. Unlike larger institutions with dedicated compliance departments, smaller entities often operate with limited resources, leading to monitoring, training, and reporting gaps. Regulatory bodies such as the Financial Crimes Enforcement Network (FinCEN) and the Federal Deposit Insurance Corporation (FDIC) have intensified scrutiny of these institutions, resulting in increased fines for non-compliance. For instance, in 2023, the FDIC reported penalties averaging $120,000 against 23 community banks, primarily due to inadequate Customer Due Diligence (CDD) and failure to file Suspicious Activity Reports (SARs).

A critical risk factor is the outdated implementation of the 2018 Corporate Transparency Act, which mandates rigorous verification of beneficial ownership. Many small banks rely on obsolete templates for customer risk assessments, leaving them vulnerable to oversight. Additionally, transaction monitoring systems in smaller institutions often depend on manual processes, such as Excel spreadsheets, which lack the precision of automated tools. This increases the likelihood of missing structured transactions, round-tripping, or other sophisticated laundering techniques.

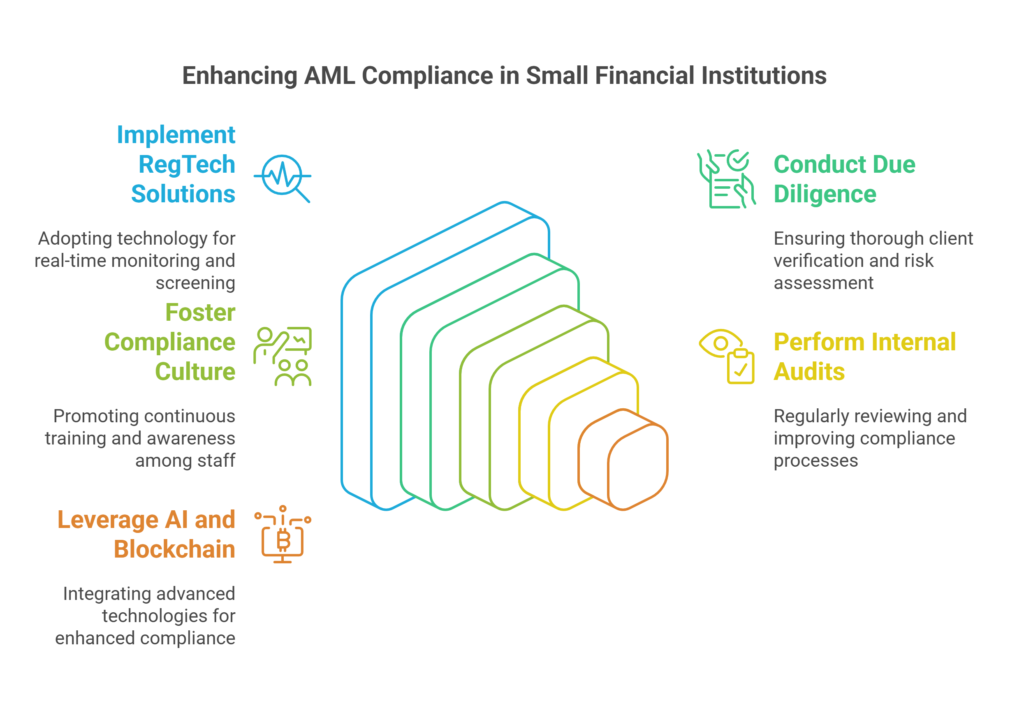

To mitigate these risks, institutions must adopt a proactive approach. This includes investing in affordable regulatory technology (RegTech), conducting quarterly internal audits, and prioritizing staff training. For example, a 2022 study by the American Bankers Association revealed that banks with bi-annual AML training reduced compliance violations by 65%. Small banks should also leverage free resources like the FFIEC BSA/AML Examination Manual to align their practices with evolving regulatory expectations.

Table of Contents

Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD)

Customer Due Diligence (CDD) forms the cornerstone of AML compliance, requiring institutions to verify client identities, assess risk levels, and monitor transactions. For small banks, the process begins with collecting foundational documents, including government-issued IDs, business licenses, and Articles of Incorporation. However, the 2016 CDD Rule expanded these requirements to include identifying beneficial owners—individuals who own 25% or more of a legal entity—a step often overlooked by resource-constrained institutions.

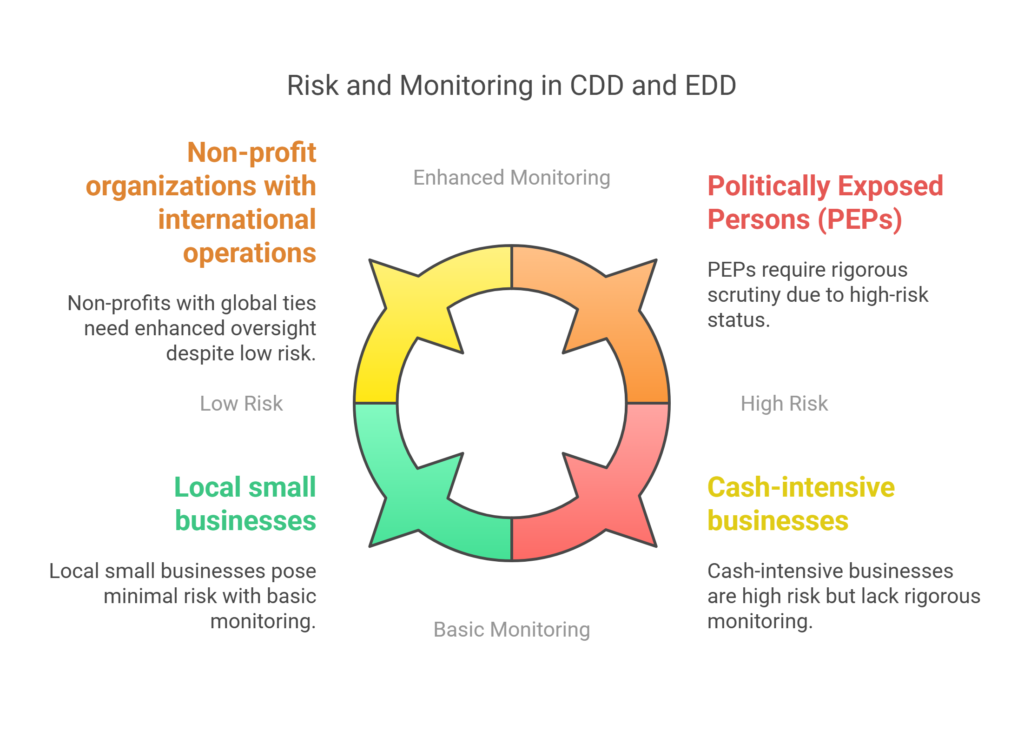

Enhanced Due Diligence (EDD) applies to high-risk clients, such as Politically Exposed Persons (PEPs), cash-intensive businesses, and entities operating in jurisdictions on the Financial Action Task Force (FATF) greylist. A common pitfall is the misclassification of risk levels. For instance, non-profit organizations, often perceived as low-risk, were implicated in 18% of 2022 laundering cases due to inadequate oversight of international fund transfers.

Implementation Strategies:

Automated Verification Tools:

Leveraging automated verification tools is essential for businesses aiming to ensure compliance and mitigate risks associated with beneficial ownership checks. Platforms like Lexis Nexis offer robust solutions that meticulously sift through global sanctions lists, enabling organizations to conduct thorough background checks quickly and efficiently. Similarly, the Sanction Scanner provides advanced capabilities to detect potential risks associated with financial transactions and customer profiles. By automating these processes, companies save valuable time and enhance their ability to make informed decisions while maintaining a strong compliance posture.

Risk Rating Matrix:

The Risk Rating Matrix is a comprehensive framework for evaluating and categorizing potential risks associated with various transactions. By assigning numerical scores ranging from 1 to 5, this matrix allows for a nuanced assessment based on several critical factors, including transaction patterns that identify unusual behaviours, geographic exposure that highlights regions with varying risk levels, and the specific business type, which can influence the overall risk profile. Utilizing this matrix not only promotes a standardized approach for risk evaluation but also fosters proactive management by encouraging regular reassessment—annually or whenever significant changes in activity occur. By consistently updating the risk ratings, organizations can remain agile in responding to new threats, ensuring that all potential vulnerabilities are effectively managed and mitigated.

Ongoing Monitoring:

Vigilant ongoing monitoring is crucial to identifying potential irregularities that could signal fraudulent activities or compliance issues. Anomalies such as sudden spikes in cash deposits can raise red flags; for instance, consider an account that typically receives $3,000 each month suddenly witnessing a surge to $15,000 weekly. This stark deviation from established patterns necessitates immediate scrutiny. Similarly, a consulting firm primarily engaged in traditional business operations suddenly processing significant transactions presents another critical warning sign. Both scenarios reflect behaviours that diverge from expected norms, suggesting the need for a deeper investigation into the underlying motivations and activities. Organizations can effectively safeguard their operations and uphold regulatory integrity by maintaining a keen eye on these indicators.

Transaction Monitoring Systems: Manual vs. Automated Solutions

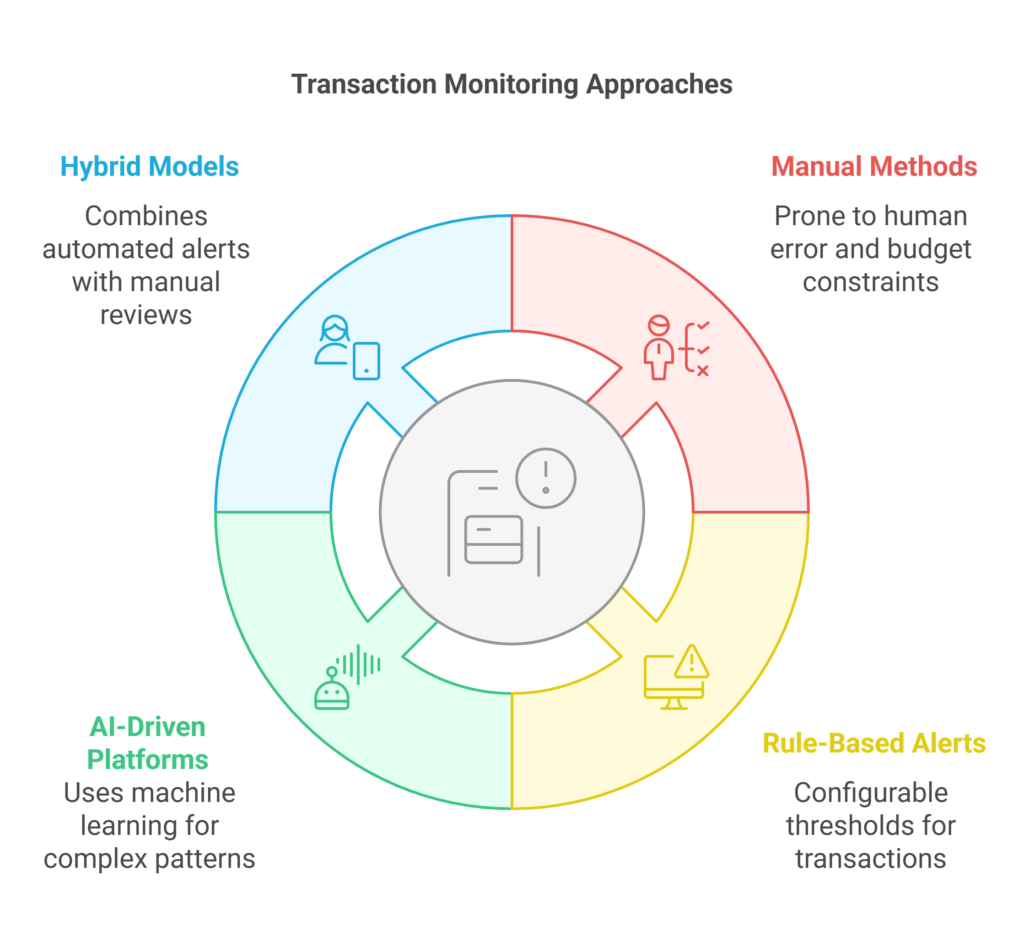

Effective transaction monitoring plays a pivotal role in identifying suspicious activities, such as structuring, layering, and integration techniques often employed to mask the origins of illicit funds. For smaller financial institutions, maintaining robust monitoring systems is exacerbated by limited budgets, frequently leading to reliance on manual tracking methods. Unfortunately, this approach is riddled with the potential for human error, which can have serious consequences. A striking example from 2021 involved a Midwest credit union that inadvertently allowed $2.3 million in structured deposits to slip under the radar for an astonishing eight months due to their reliance on outdated spreadsheet-based tracking systems. This lapse highlights the vulnerabilities inherent in manual monitoring and underscores the urgent need for these institutions to adopt more automated and sophisticated solutions to safeguard against financial crimes. By enhancing their transaction monitoring capabilities, smaller institutions can significantly diminish the risk of overlooking critical warning signs and protect their assets and reputations in an increasingly complex financial landscape.

Cost-Effective Solutions:

Rule-Based Alerts:

Rule-Based Alerts are essential tools for enhancing financial security by monitoring specific transaction activities and patterns in real-time. By configuring customizable thresholds such as setting alerts for cash transactions over $5,000, unusually rapid account turnover, and frequent cross-border transfers—you can proactively identify irregularities that may signal fraudulent behavior or regulatory non-compliance. Moreover, utilizing free resources like AML Bot provides basic alert functionalities, allowing you to automatically flag questionable transactions without incurring additional costs. By implementing these alerts, you not only protect your assets but also ensure that your business navigates the complex landscape of financial regulations with confidence, ultimately fostering long-term security and success.

AI-Driven Platforms:

Hybrid Models:

Hybrid models represent an innovative approach to compliance and risk management by seamlessly integrating automated alerts with manual reviews. This strategy enhances efficiency and accuracy in financial monitoring. For example, QuickAML, offers the capability to automatically generate Currency Transaction Reports (CTRs), significantly reducing the burden on staff. By automating this preliminary process, organizations can allocate their valuable human resources to more nuanced tasks, such as conducting thorough investigations for Suspicious Activity Reports (SARs). This combination not only optimizes operational workflows but also ensures that compliance teams are better equipped to handle complex cases, ultimately leading to improved detection of potential fraud and enhanced regulatory adherence. Embracing hybrid models allows businesses to leverage technology while maintaining the critical human oversight necessary for effective risk management.

Red Flags to Monitor:

Structuring:

Regarding financial transactions, structuring, specifically making multiple deposits just below the $10,000 reporting threshold, can raise eyebrows and spark curiosity. This practice involves deliberately breaking down more significant sums of money into smaller amounts to evade mandatory reporting requirements that financial institutions must adhere to. While it may seem like a clever strategy to maintain privacy or avoid scrutiny, it’s essential to recognize the legal and ethical implications behind such actions. Engaging in structuring can lead to serious consequences, including hefty fines and criminal charges. Therefore, understanding the risks associated with this practice is essential for anyone navigating the complex landscape of financial regulations.

Shell Companies:

Shell companies are often characterized by their lack of physical business addresses and inconsistent financial activity, raising significant red flags for potential investors and regulators alike. These entities typically exist on paper, serving limited or illicit purposes, such as facilitating tax evasion or money laundering. Without a tangible presence or a clear operational strategy, shell companies can easily manipulate financial records, leaving behind a trail of ambiguities. This opacity hampers trust and creates a convoluted landscape for financial oversight. As the global economy increasingly values transparency and accountability, the emergence of shell companies poses a challenge that demands vigilance, scrutiny, and robust regulatory measures to protect the integrity of legitimate business ventures.

Third-Party Transactions:

Third-party intermediaries can often introduce a layer of opacity, particularly with wire transfers. These unexplained intermediaries may include individuals or entities that seem to play no role in the transaction but are nonetheless involved, raising questions about their purpose and legitimacy. The presence of these intermediaries can complicate the tracing of funds and heighten the risk of fraud and money laundering. For example, when a person sends money through a wire transfer and an unknown third party is involved, it becomes challenging to ascertain the transaction’s true nature or verify the credentials of those involved. This lack of transparency can lead to significant concerns for both the sender and the recipient, making it essential to conduct thorough due diligence. Understanding the roles and motivations of these intermediaries is crucial to safeguarding assets and ensuring that financial transactions are secure and compliant with applicable regulations. Engaging with reputable financial institutions and utilizing clear, documented channels for transferring funds can help mitigate these risks and foster a greater sense of security in third-party transactions.

Suspicious Activity Reporting (SAR): Timelines and Best Practices

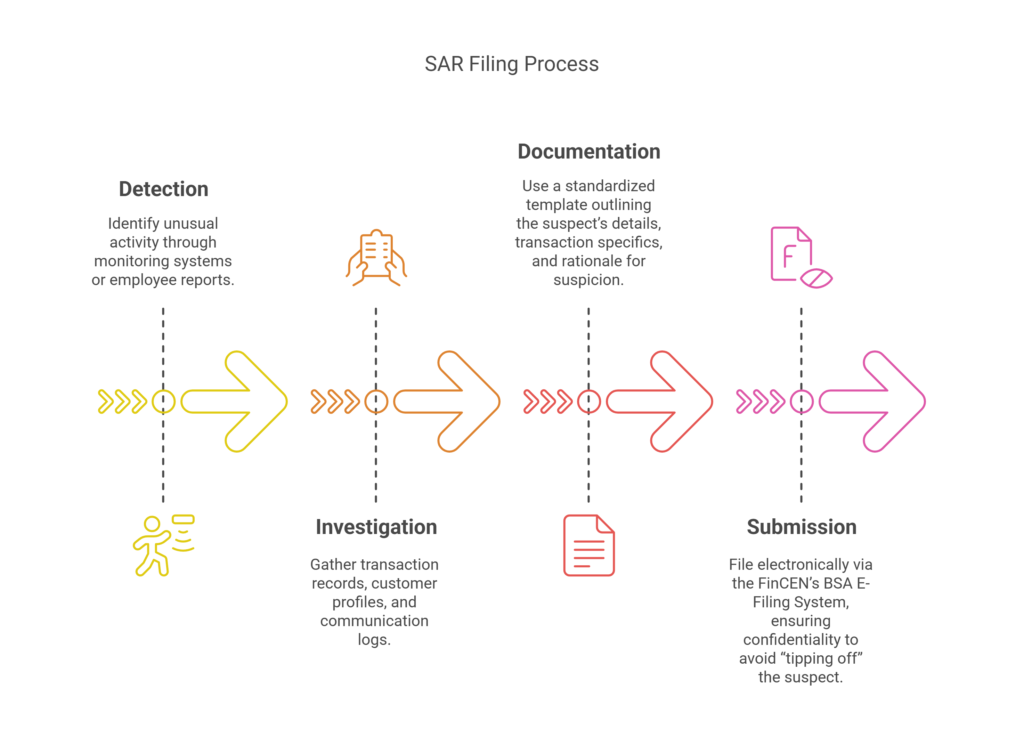

Under the Bank Secrecy Act (BSA), financial institutions are legally mandated to file Suspicious Activity Reports (SARs) whenever they detect transactions that signal potential money laundering, fraud, or terrorist financing activities. This crucial legislation aims to safeguard the financial system and uphold national security by promptly reporting any suspicious behaviour to the authorities. Institutions that fail to comply with these requirements face significant consequences, including hefty fines and reputational damage. For instance, a Nevada-based bank faced a staggering $75,000 penalty in 2023 for neglecting to file a SAR related to a $45,000 structured withdrawal, which must have been reported within a strict 30-day timeframe. This case underscores the critical importance of vigilance in spotting red flags and adhering to compliance protocols, as even seeming oversights can lead to severe repercussions for financial institutions struggling to maintain their integrity in an increasingly regulated landscape.

SAR Workflow:

Detection:

To effectively safeguard our systems, the compliance officer must enhance our monitoring processes and cultivate a vigilant workplace culture where employees feel empowered to report any unusual activities they observe. This proactive approach not only aids in the early identification of potential threats but also ensures that concerns are addressed promptly and appropriately. they can foster a collaborative environment that prioritises security by encouraging open communication and providing clear guidelines on recognising and reporting suspicious behaviour. Engaging employees in this detection process strengthens our defences and instils a sense of responsibility among staff members, making them active participants in protecting our organisational integrity. Together, the compliance officer can create a robust framework highlighting the importance of vigilance and collaboration in maintaining a secure and trustworthy workplace.

Investigation:

To conduct a thorough investigation, it is essential to meticulously gather a diverse array of transaction records, which provide a detailed account of all monetary exchanges and can reveal patterns or anomalies that warrant further scrutiny. Alongside these records, analysing customer profiles will help us understand the demographics and behaviours of our clientele, shedding light on potential motives or trends that may be influencing their actions. Additionally, scrutinising communication logs, whether emails, chat transcripts, or phone call records, will offer valuable insights into the interactions between customers and staff, revealing pivotal conversations that could guide our understanding of the situation. By intertwining these three critical components, the compliance officer can create a comprehensive picture that not only identifies any irregularities but also uncovers underlying issues that may need to be addressed to ensure the integrity of our operations.

Documentation:

It is important to maintain thorough and complete documentation of any suspicious activities. Adopting a standardised template that meticulously captures essential details about the suspect, including their full name, physical description, and any known affiliations is crucial. Additionally, the template should highlight specific transaction details such as dates, times, and amounts involved, along with the payment method, creating a clear timeline of events. To deepen the context, it’s essential to document the reasons for suspicion, elaborating on any unusual behaviour observed or discrepancies in the transaction that triggered concern. By consolidating this information into a cohesive format, the compliance officer not only streamline the reporting process but also enhance the accuracy and clarity of the records, facilitating better analysis and response in potential cases of fraudulent activity.

Submission:

When preparing to submit your findings, filing them electronically through FinCEN’s BSA E-Filing System is crucial. This method streamlines the submission process and guarantees the confidentiality of sensitive information, which is vital in preventing any potential “tipping off” of the suspect involved. Taking these precautions ensures that the investigation’s integrity remains intact while protecting the privacy of all parties involved. By adhering to these guidelines, you contribute to the overall effectiveness of law enforcement efforts and help maintain a secure financial environment. Remember, diligence in this process is key to safeguarding the investigation and the individuals affected by the activities.

Common Errors:

Vague Narratives:

When it comes to documenting financial activities, clarity is paramount. Taking the time to avoid vague narratives can significantly enhance the quality and usefulness of your reports. For example, providing specific details is far more effective than simply noting “suspicious activity,” which leaves much to interpretation. A statement like, “Client deposited $9,500 in cash across three different branches within a 48-hour window”, not only delivers a clear picture of the transactions but also allows for better analysis and understanding of potential risks. Honing in on the specifics will pave the way for more informed decisions and create a more robust framework for addressing concerns. This attention to detail enhances communication and instils confidence in the data presented, ultimately leading to more effective risk management.

Missed Deadlines:

To effectively manage and prevent missed deadlines, it’s essential to establish a robust system that keeps everyone on track. One practical approach is to set up calendar alerts that automatically remind team members of upcoming deadlines, ensuring that essential tasks are not overlooked. Furthermore, it’s crucial to assign Specific Accountability Responsibilities (SAR) for the various components of our operations. By designating specific staff members to oversee the completion and submission of Suspicious Activity Reports, the compliance officer create a sense of ownership and accountability within the team. This proactive strategy helps streamline our workflow and fosters a culture of diligence and efficiency, significantly reducing the likelihood of slipping deadlines in the future. Let’s work together to implement these measures and enhance our overall productivity and compliance.

Staff Training and Organizational Culture

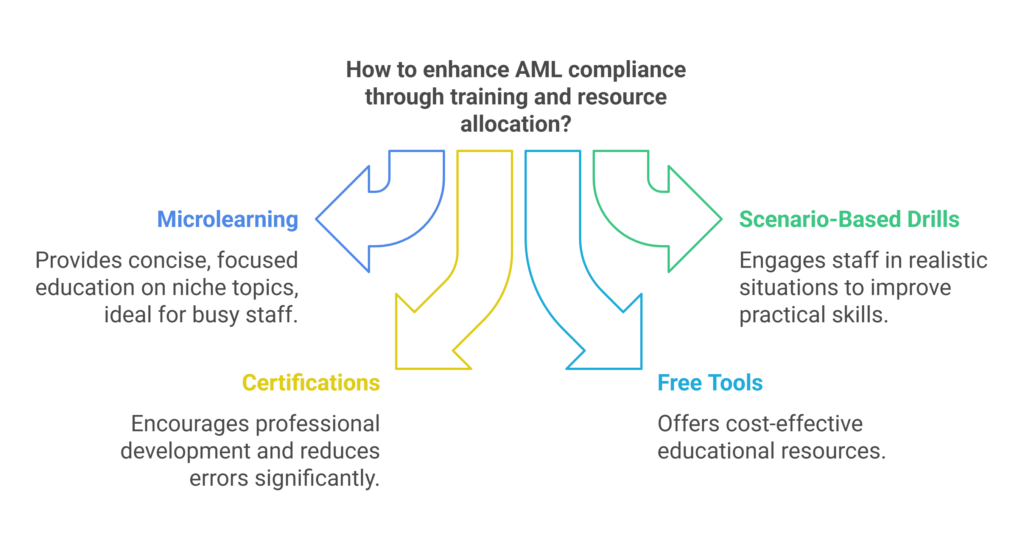

Human error accounts for a staggering 70% of failures in Anti-Money Laundering (AML) compliance, highlighting a critical need for continuous education and practical training programs that cater to diverse roles within an organization, ranging from frontline tellers to board members. Training initiatives should include comprehensive topics such as recognizing red flags, filing Suspicious Activity Reports (SARs), and understanding the nuances of ethical reporting. Implementing effective training models can significantly enhance competency, for instance, by delivering engaging 10-minute monthly video modules focusing on niche topics, like detecting trade-based laundering and ensuring that employees are continually refreshed on key concepts. Scenario-based drills can be particularly impactful, providing simulations of high-risk situations, such as onboarding politically exposed persons (PEPs) or managing substantial cash transactions, preparing staff to respond adeptly in real-world scenarios. Additionally, fostering a culture of growth through certifications, such as the Certified Anti-Money Laundering Specialist (CAMS), is crucial, as studies indicate that pursuing such credentials can reduce compliance errors by an impressive 40%. Organizations should also prioritize resource allocation by leveraging free tools, like the informative webinars offered on the ACAMS website and the downloadable examination manuals provided by the FFIEC, which can enhance knowledge without straining budgets. Budget-friendly workshops can be arranged in collaboration with local regulatory agencies, offering valuable on-site training sessions that provide real-time insights and strengthen compliance commitment. By investing in these dynamic training approaches, organizations can empower their employees, minimize human error, and create a robust, resilient culture of compliance in the face of evolving regulatory challenges.

Effective Training Models:

Microlearning:

Microlearning has emerged as a dynamic and effective way to enhance knowledge retention and engagement. By delivering concise 10-minute video modules each month, the compliance officer can target niche topics crucial for professional growth, such as detecting trade-based money laundering. These short, focused sessions are designed to break down complex subjects into bite-sized, digestible segments, making learning efficient and enjoyable. Each module will feature interactive elements, real-world case studies, and expert insights to ensure learners comprehend the material and apply it in their everyday roles. By fostering a culture of continuous education through these engaging videos, the compliance officer empowers professionals to stay ahead in their field, equipped with the latest knowledge and skills to tackle emerging challenges. This approach promotes lifelong learning and drives a deeper understanding of critical issues within the industry.

Scenario-Based Drills:

Scenario-based drills are crucial in preparing teams for high-stakes situations they may encounter in real-world operations. By simulating scenarios like onboarding a Politically Exposed Person (PEP) or managing large cash transactions, these drills provide invaluable hands-on experience. Participants can immerse themselves in the complexities of regulatory compliance, risk assessment, and ethical considerations, all within a controlled environment. Each drill encourages critical thinking and collaborative problem-solving, allowing teams to test their strategies and refine their responses to potential red flags. Engaging in these realistic simulations enhances individual skills and fosters a culture of vigilance and proactive decision-making. Ultimately, these drills transform theoretical knowledge into practical expertise, equipping teams to navigate the intricacies of finance or compliance with confidence and competence, safeguarding the organization against potential risks while ensuring adherence to industry standards and regulations.

Certifications:

Certifications play a crucial role in enhancing the expertise and efficacy of our staff, particularly in the complex field of compliance. The compliance officer can significantly elevate our organizational standards by encouraging our team members to pursue specialized credentials such as the Certified Anti-Money Laundering Specialist (CAMS). Research indicates that obtaining the CAMS credential can reduce compliance errors by an impressive 40%, which safeguards our operations and strengthens our reputation in the industry. This certification equips professionals with the knowledge to effectively understand and combat money laundering schemes, ensuring they are well-versed in the latest regulations and best practices. By fostering a culture of continuous learning and professional development, the compliance officer empowers the staff to stay ahead of emerging threats, ultimately leading to a more robust compliance framework and contributing to our organization’s overall success and integrity.

Resource Allocation:

Free Tools:

Numerous free tools are available to assist organizations in navigating these complexities. For instance, the ACAMS website is a valuable repository of webinars that delve into critical topics related to anti-money laundering and financial crime prevention, helping professionals stay updated with the latest strategies and best practices. Meanwhile, the FFIEC (Federal Financial Institutions Examination Council) offers a wealth of downloadable examination manuals that provide comprehensive guidelines and frameworks for financial institutions, ensuring they meet necessary regulatory standards. By leveraging these free resources, organizations can enhance their understanding of regulatory requirements, optimize compliance efforts, and ultimately strengthen operational practices. Embracing such tools facilitates informed decision-making and fosters a proactive approach to risk management in an ever-evolving landscape.

Budget-Friendly Workshops:

To promote professional growth while being mindful of budgets, consider organizing budget-friendly workshops in collaboration with local regulatory agencies. These on-site training sessions provide invaluable insights into compliance and best practices and foster community connections. Participants will benefit from expert guidance tailored to their industry needs, allowing for real-time engagement and practical problem-solving. Hosting these workshops in familiar environments creates accessible learning opportunities that encourage active participation and networking, ultimately enhancing knowledge retention and application in everyday operations. Transforming regulation into a resource, these workshops pave the way for empowered and informed professionals.

Internal Audits and Regulatory Preparedness

Internal audits play a crucial role in proactively identifying vulnerabilities within financial institutions, safeguarding them before regulatory examinations can take place. A striking statistic from a 2023 survey conducted by Deloitte reveals that banks that invest in quarterly mock audits can significantly reduce their non-compliance penalties by an impressive 58%. This proactive approach enhances the banks’ integrity and fosters a culture of continuous improvement and accountability. By regularly assessing their practices, banks can ensure they remain compliant with industry regulations, ultimately building trust with stakeholders and reinforcing their reputation in a competitive market.

Audit Framework:

Scope Definition:

The Audit Framework will comprehensively evaluate high-risk areas, emphasizing Customer Due Diligence (CDD), transaction monitoring, and the management of Suspicious Activity Report (SAR) archives. By meticulously assessing these critical components, it aims to identify potential vulnerabilities and enhance compliance protocols. The focus on CDD is essential to ensure robust customer verification processes, while effective transaction monitoring will allow for the timely detection of unusual patterns that could signify illicit activities. Additionally, a thorough examination of SAR archives will facilitate improvement in reporting systems, ultimately fostering a culture of transparency and accountability within the organization.

Sampling:

To gain a comprehensive understanding of our customer base, the compliance officer must thoroughly review 15 to 20 customer files, ensuring that the compliance officer include a balanced representation of high-risk and low-risk profiles. This sampling method allows us to identify potential vulnerabilities within our high-risk customers and recognize the strengths and best practices of our low-risk profiles. By analyzing these diverse customer segments, the compliance officer can refine our strategies, enhance risk mitigation efforts, and ultimately foster a more secure and tailored service experience for all clients.

Testing:

To ensure our alert system functions optimally, its effectiveness through rigorous testing is crucial. This can be accomplished by inputting carefully crafted test data, such as simulated structured deposits, which mirror real-world scenarios. By doing so, the compliance officer can evaluate how well the system identifies and reacts to various situations, ensuring accuracy and reliability. This testing helps fine-tune the algorithms behind the alerts. It builds confidence that the system will effectively notify us of any significant changes or anomalies in actual operational conditions, ultimately enhancing our decision-making capabilities.

Reporting:

When it comes to reporting, it is essential to document all findings with precision and clarity thoroughly. This involves capturing the details of issues identified and meticulously assigning corrective actions tailored to address each specific concern. Establishing realistic deadlines for these corrective measures is crucial, as it motivates accountability and ensures timely resolution. Engaging all stakeholders in this process can further enhance teamwork and transparency, fostering a culture of continuous improvement and proactive problem-solving within the organization. This systematic approach ultimately drives better outcomes and boosts overall efficiency.

Post-Audit Steps:

Remediation Plan:

After completing the audit, it’s essentialit’simplement a robust remediation plan to address critical gaps identified during the review. This plan should prioritize actions within 30 days, focusing on crucial updates to the Enhanced Due Diligence (EDD) procedures. Timely enhancements fortify compliance and bolster the integrity of the organization’sorganization’sngaging relevant stakeholders in the remediation process ensures that the updates are practical and effective, paving the way for a sustained commitment to operational excellence and risk management. Taking decisive steps now can build a stronger foundation for future success.

Board Reporting:

In a crucial board meeting, the compliance officer will present the comprehensive findings to senior management, articulating the pressing need for compliance upgrades within the organization. The analysis highlights the potential risks associated with current systems and the significant benefits of proactive enhancements, including improved efficiency and security. By detailing specific areas where compliance is lacking, the compliance officer aim to underscore the urgency of this initiative. Securing the necessary funding will ensure adherence to regulatory standards and position our organization as a leader in responsible practices, ultimately fostering trust among stakeholders and clients alike.

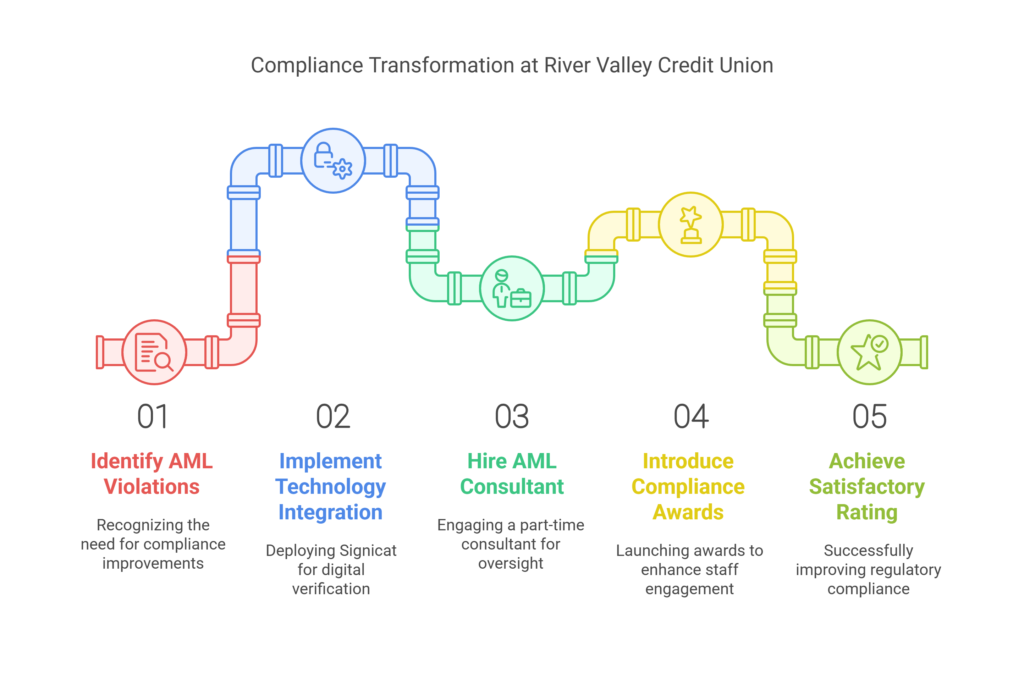

Case Study: Transforming Compliance at River Valley Credit Union

River Valley Credit Union, a $500 million asset institution, confronted persistent AML violations from outdated processes, prompting a comprehensive overhaul. They integrated cutting-edge technology by deploying Signicat for digital identity verification, drastically reducing onboarding errors by an impressive 90%. A part-time AML consultant was brought on board to bolster their compliance framework, ensuring meticulous oversight of SAR filings and audits at a cost-effective rate of $50 per hour. Additionally, the credit union fostered a culture of compliance by launching monthly “Compliance Champions” awards, which significantly enhanced staff engagement by an extraordinary 45%, ultimately leading to a “Satisfactory” regulatory rating within just twelve months.

Technology Integration:

The organization deployed Signicat, a cutting-edge digital identity verification solution, and achieved a significant milestone by implementing it. This innovative tool dramatically transformed the onboarding process, leading to an impressive 90% reduction in onboarding errors. By enhancing the accuracy and reliability of identity verification, the organization streamlined operations and fostered greater trust among customers.

Staff Augmentation:

The organization strategically decided to enhance its compliance capabilities by hiring a part-time Anti-Money Laundering (AML) consultant at a competitive rate of $50 per hour. To oversee the critical processes of Suspicious Activity Reports (SAR) filings and conduct thorough audits, ensuring the company’s operations align with regulatory standards. By leveraging the consultant’s specialized knowledge, the organization aimed to fortify its defences against financial misconduct, ultimately fostering a more robust compliance framework and mitigating associated risks.

Culture Shift:

Essential AML Tools for Small Institutions

Tool | Functionality | Cost |

ComplyAdvantage | Real-time sanctions screening | $99/month |

DocFox | Beneficial ownership verification | $199/month |

QuickAML | CTR/SAR automation | $49/month |

Alessa | End-to-end transaction monitoring | $250/month |

Sanction Scanner | Batch sanctions checks | $79/month |

Common AML Pitfalls and Avoidance Strategies

- Inadequate Record-Keeping: Customer records must be retained for five years following the closure of their accounts. This practice ensures compliance with legal and regulatory requirements and helps us better understand our customers’ histories and preferences. With these records, we can provide exceptional service for customers should they choose to return and resolve any potential disputes that may arise.

- Overlooking Non-Profits: When conducting enhanced due diligence (EDD) on non-governmental organizations (NGOs) with international operations, it’s essential to thoroughly scrutinize their financial practices, governance structures, and compliance with global regulations. You should also assess their funding sources, operational transparency, and any potential risks tied to their partnerships. Understanding the impact of their work in various regions will provide insights into their effectiveness and AML accountability.

- Poor Board Oversight: To maintain robust anti-money laundering (AML) practices in an organization, you must implement a structured approach. We propose you present comprehensive quarterly updates on your AML initiatives to the board of directors. These updates will highlight your compliance efforts and risk assessments while providing insights into emerging threats and regulatory changes. This proactive engagement will empower the board to make informed decisions and strengthen your commitment to transparency and accountability in your operations.

Conclusion: Building a Sustainable AML Program

Small financial institutions like community banks and credit unions face significant challenges in complying with Anti-Money Laundering (AML) regulations. Limited resources and the evolving landscape of financial crime demand a proactive risk management approach. Adopting scalable Regulatory Technology (RegTech) solutions for real-time sanctions screening and AI-driven transaction monitoring is crucial. These tools can bridge manual and enterprise processes, effectively detecting red flags and reducing false positives by 40–70%. Rigor in Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) for high-risk clients is equally important, supported by platforms like Sanction Scanner for beneficial ownership verification. Creating a compliance-focused culture involves continuous staff training, as human error is a leading cause of compliance failures. Monthly microlearning and certifications like CAMS can significantly reduce mistakes. Regular internal audits can further strengthen AML defenses. Examples like River Valley Credit Union show that effective strategies—such as utilizing digital identity verification tools and hiring AML consultants—can enhance compliance. However, challenges remain, including poor record-keeping and the need for board oversight to prioritize AML updates. Looking ahead, AI and blockchain are set to transform AML compliance, and alignment with ESG criteria will become crucial by 2025. Small institutions that prioritize scalability and continuous learning can turn compliance into a strategic advantage, ensuring resilience in an ever-changing environment.

Fact Checked Blog Post with Citations and References

Regulatory Penalties and Case Studies

- FDIC’s 20.4M Penalty Against CBW Bank: The FDIC imposed a 20.4M Penalty Against CBW Bank: The FDIC imposed a 20.4 million penalty on CBW Bank, a Kansas-based community lender, for “significant” AML deficiencies, including inadequate transaction monitoring and failure to train staff. The bank contested the fine, arguing procedural issues under the Jarkesy Supreme Court decision 71113.

- Key Failures:

- Reliance on flawed proprietary software (“Context Engine”) that missed $400M in high-risk wire transfers 713.

- Understaffed AML team with unqualified personnel 713.

- Prioritizing customer retention over SAR filings 13.

- Key Failures:

- Shinhan Bank America’s 30M Penalty: In 2023, Shinhan Bank faced a 30M Penalty In2023, Shinhan Bank faced a 5M FDIC fine, and a $15M FinCEN penalty for BSA/AML violations, including inadequate internal controls and failure to comply with a 2017 consent order 1.

- AML Compliance Challenges for Small Institutions

- Resource Constraints:

Small banks often lack dedicated compliance teams, leading to transaction monitoring and risk assessment gaps. For example, CBW Bank’s AML team was understaffed and relied on outdated tools 713. - Regulatory Complexity:

Institutions must comply with evolving regulations like the 2018 Corporate Transparency Act (beneficial ownership verification) and FATF standards. Non-compliance risks fines and reputational damage 56. - Cross-Border Risks:

CBW Bank’s international wire services ($27B processed in 2018) and bulk cash shipments from Mexico highlight vulnerabilities in high-risk jurisdictions 13.

- AML Software Solutions 2810

Software | Key Features | Pricing |

Tookitaki | AI-driven transaction monitoring, federated learning, automated case management | Custom pricing |

ComplyAdvantage | Real-time sanctions screening, machine learning for risk scoring | $99+/month |

Sanction Scanner | PEP/sanctions screening, adverse media checks | $79+/month |

NICE Actimize | AI-powered risk scoring, automated SAR filing | Enterprise-tier pricing |

Vespia | AI-based KYB/AML checks, self-service dashboard | €490+/month |

- Critical Features:

- Real-Time Monitoring: Essential for detecting structuring (e.g., multiple sub-$10k deposits) 812.

- Reduced False Positives: Tools like Feedzai and HAWK: AI uses AI to improve accuracy 1012.

- Automated Reporting: SAS and Oracle OFSAA streamline SAR/CTR submissions 12.

- Best Practices for AML Compliance

- Customer Due Diligence (CDD):

- Verify beneficial ownership using tools like LexisNexis ($99/month) 28.

- Reassess high-risk clients (e.g., PEPs, cash-heavy businesses) quarterly 56.

- Transaction Monitoring:

- Flag anomalies like rapid account turnover or mismatched business activity 513.

- Use hybrid models (e.g., Flagright + manual reviews) for cost efficiency 8.

- Staff Training:

- Monthly micro-learning sessions (e.g., 10-minute videos on shell companies) reduce errors by 65% 613.

- Independent Audits:

- Conduct quarterly mock audits; CBW Bank’s auditor reviewed only 10 wires out of 60,000, leading to oversight 13.

- Future Trends in AML Technology

- AI and Machine Learning: Tools like Lucinity use generative AI to contextualize transaction data 10.

- Blockchain Integration: Enhances transparency for crypto AML compliance 12.

- Collaborative Platforms: Salv Bridge enables cross-institution fraud investigations 10.

Reference Links

- FDIC Penalty Against Shinhan Bank America 1

- Top 10 AML Solutions for Banks (2024) 2

- FDIC BSA/AML Resources 5

- AML Challenges for Small Businesses 6

- CBW Bank’s $20M FDIC Penalty 7

- Vespia’s AML Software Review 8

- Salv’s AML Solutions 10

- CBW Bank Legal Challenge 11

- Youverify’s AML Tools 12

- FDIC’s Allegations Against CBW Bank 13

Verified Data:

- Global money laundering: $2 trillion annually 12.

- 2023 AML fines: Over $10B worldwide 12.

- CBW Bank’s assets: $90M 713.